The challenge

Increased deployment of renewable generation, large capital investments of managing grid peak demands, and high capital cost in grid infrastructure for reliability are creating new interest in electric energy storage system.

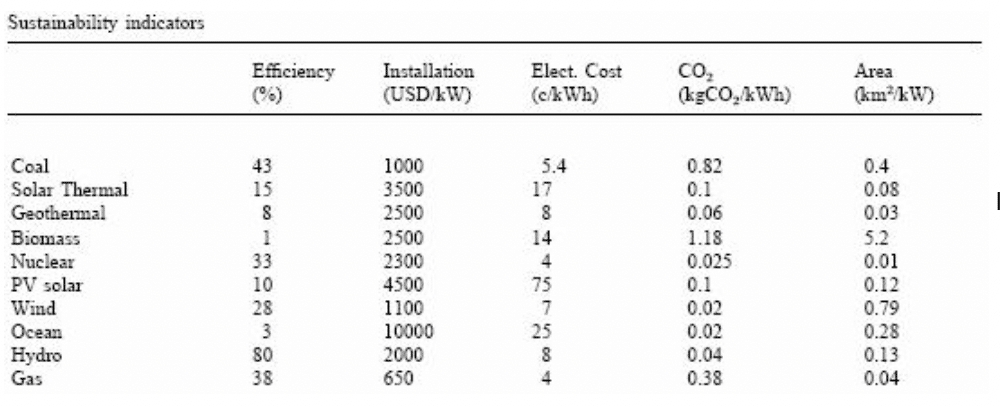

Dozens of energy storage technologies, pumped hydro, compressed air energy storage system, sodium sulfur battery, advanced lead acid battery, flywheel, vanadium redox battery, Zn/Br redox, Zn/air redox, Li-ion battery, Zn/Br flow cell, Fe/Cr flow cell, Zn/Br flow cell, etc., are emerging which help balance variable renewable generation and properly integrated and deployed, and help increase the asset utilization and electric grid reliability.

Different energy storage systems have different multi-functional characteristics, which makes the rules for ownership and operations among variables shareholder complicated. Electric Power Research Institute (EPRI) asked Energy and Environmental Economics, Inc.

(E3) to create a framework to help California Public Utilities Commission (CPUC) and California Energy Commission (CEC), the large California investor-owned utilities (PG&E, SCE, and SDG&E) and others to evaluate the benefits of applications and life-cycle costs of these different energy storage systems.

The consultants used a collaborative process with workshops, interviews and meetings with stakeholders to develop an open-source tool. The model was required to estimate the 21 benefits of different applications in the categories from generation and system-level applications through T&D system applications to end-user applications.

Why Analytica?

E3 wanted a modeling platform that made model structure and assumptions transparent and could be easily used by a variety of stakeholders. They considered excel spreadsheets but eventually chose Analytica.

“Even with a number of analysts experienced in Excel with VBA, we have found Excel/VBA models time consuming to update and debug for each new project with slightly different requirements. As the VBA modules became more complex, they became difficult to document and transfer between analysts. Finally, once a model relies heavily on VBA, it severely limits its transparency and the opportunity for review in the public review processes that are central to regulatory oversight and policy development in the energy utility industry. Analytica’s use of modules and nodes makes the modeling approach and flow visibly transparent to the user. Formulas, along with a list of their inputs and outputs, are easily viewed and understood. Both a downloadable free player and a web interface allow anyone to use and view the full model. These features support the transparency and accessibility that is fundamental to all public analysis performed by E3.”

Eric Cutter, Project Manager

“When we decided to expand the scope of our analysis for this project, Analytica’s Intelligent Arrays™ allowed us to make simple changes that propagated throughout the model. The time savings offered by Analytica relative to Excel was tremendous.”

“For this tool, we need to optimize the hourly system energy dispatch scheme to maximize the revenues from participating energy and AS markets. This optimization problem involves many interacting constraints due to technology characteristics and market regulations. The structured Analytica Optimizer make the optimization model more intuitive, transparent and scalable, and so much easier to build.”

Ben Haley, Lead Analytica Modeler

The solution

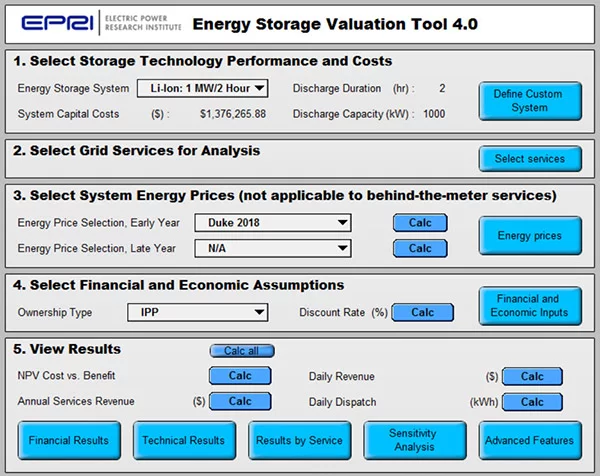

E3 used Analytica Optimizer and Analytica Cloud Player to develop a publicly available tool to explore the cost-effectiveness of dozens of energy storage technologies. With the technology characteristics inputs, 8,760 hourly customer load data, retail electricity rates, etc., the tool estimates the life cycle of costs and benefits for each energy storage technology.

The model offers a highly interactive, transparent and intuitive user-interface which allows them to adjust key assumptions, such as the service area, application type, ownership type, discount rate, years financed, and technology performance characteristics and costs including technology lifetime, discharge capacity, discharge duration, charge capacity, unit capital costs.

It displays visual influence diagrams that allow users to explore the details of the model, as shown below.

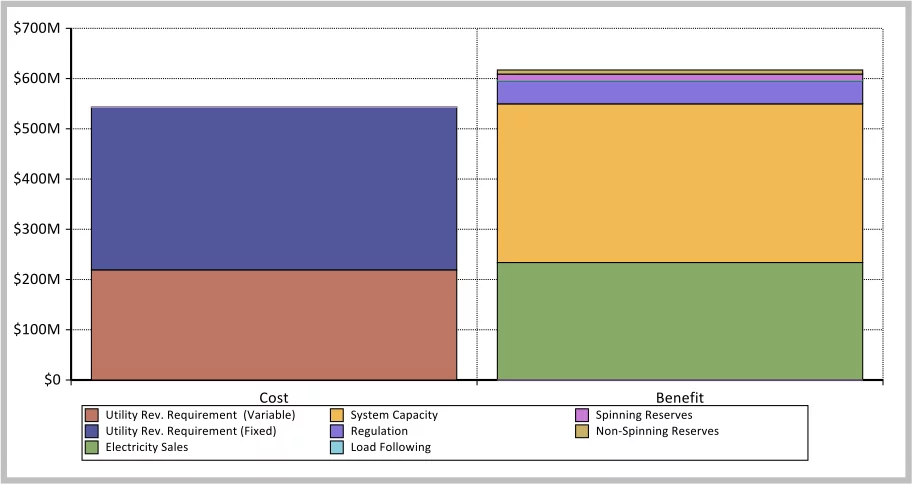

In this energy storage evaluation model, there are a lot of uncertain inputs including technology durability, cycle life costs and risks, and financial inputs.

It’s very helpful to conduct a sensitivity analysis, uncertainty analysis and scenario analysis for to identify which inputs are the key drivers. Analytica Optimizer comes with a library for sensitivity analysis, uncertainty analysis and scenario analysis.

By setting up the input variables and outputs, you can conduct such analysis in a few minutes.

Results

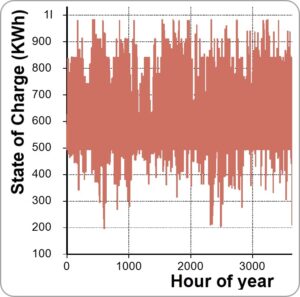

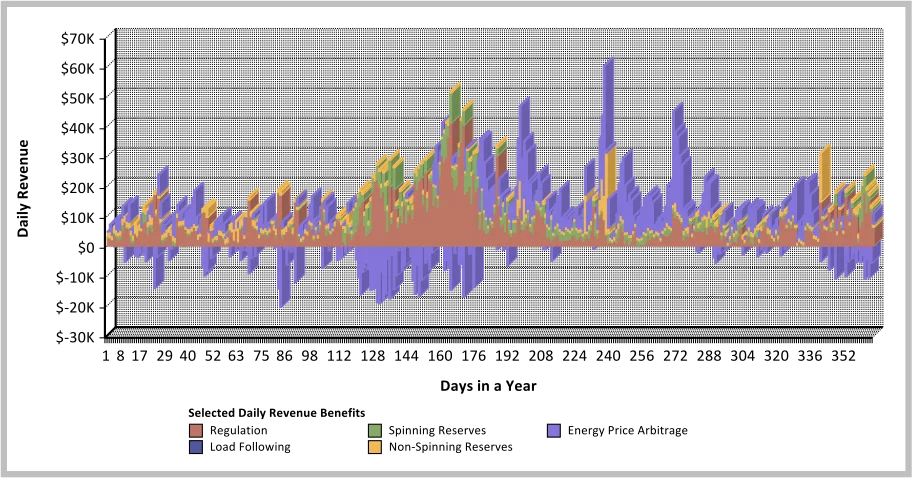

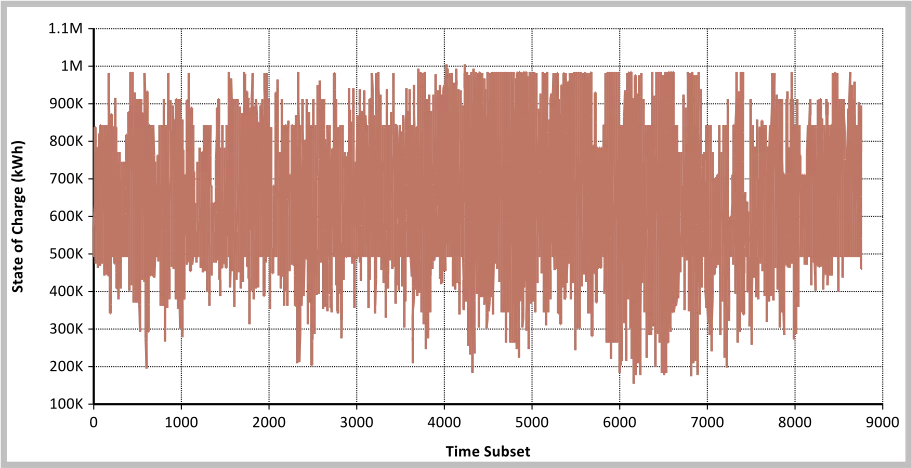

The model allows users to interactively explore the effect on outputs of changing input assumptions. Figures 1-3 are sample results to operate a 180 MW CAES plant.

Authors

Mr. Eric Cutter (E3), Mr. David Miller (E3), Mr. Ben Haley (E3)

Lumina consultants, Xirong Jiang and Max Henrion, assisted E3 in developing the optimization algorithm and user interface.

For more

This model was built by Energy, Environmental and Economics Consulting Inc. (E3) with assistance by Lumina, for the Electric Power Research Institute (EPRI). For more information, please visit the E3 project webpage.