Monte Carlo Simulation Software Comparison

Looking for a review of the best software to analyze and manage risk and uncertainty? Here’s a comparison table summarizing key features of leading Monte Carlo simulation tools. For readers who need help choosing the right tool, please refer to the selection guide provided later in this article. Below that, we explain each feature. We then describe each product, highlighting its capabilities and suitable applications, listing pros and cons, pricing, and website. We’ll start with spreadsheet add-ins that conveniently let you add Monte Carlo simulation into your existing Excel spreadsheets. We then describe two stand-alone products, which tend to be faster and more flexible since they don’t have to retrofit Excel software.

Best Monte Carlo simulation software: Feature and pricing comparison

| Product | Maker | Type | Platform | Tornado charts | LHS | Sobol | Importance sampling | Meta-log | SIP-math | Dependent inputs | Optimizer | Free version | Annual price* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| @RISK | Palisade | Excel add-in | Windows | ✔ | ✔ | — | — | — | — | ✔ | $ | Free trial 15 days | $2,900 Professional; $3,500 Industrial |

| Analytic Solver | Frontline Systems | Excel add-in | Windows, Web | ✔ | ✔ | ✔ | — | ✔ | ✔ | ✔ | $ | Free trial 15 days | $2,500 to $6,000 |

| ModelRisk | Vose Software | Excel add-in | Windows | ✔ | — | — | — | — | — | ✔ | — | Free trial 15 days | €1,450 (~$1,690) |

| ChanceCalc+ | Probability Management .org | Excel add-in | Windows, Macintosh | — | — | — | — | ✔ | ✔ | — | — | Free for education | $1,500 one-time price |

| Crystal Ball | Oracle | Excel add-in | Windows | ✔ | ✔ | — | — | — | — | — | $ | ? | Not offered for new sales |

| Analytica | Lumina Decision Systems | Stand-alone | Windows, Web | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | $ | Free 101 objects, no time limit | Free or $1,000 Pro; $2,000 Developer |

| GoldSim | GoldSim Technology Group | Stand-alone | Windows | ✔ | ✔ | — | ✔ | — | — | — | — | Free trial 30 days | $2,750 |

* Features and prices based on public website information as of August 2025. Most Monte Carlo simulation software providers offer an academic discount. “$” means a version with optimizer/solvers is available at a higher price.

Selection guide for Monte Carlo Simulation software

- Spreadsheet integration

- Choose @RISK, Analytic Solver, ModelRisk, ChanceCalc+, or Oracle Crystal Ball if you want to stay within Excel.. Best if you already have spreadsheet-based models or prefer a familiar interface.

- Platform compatibility

- All tools support Windows.

- ChanceCalc+ also works with Excel for Macintosh.

- Analytic Solver and Analytica provide browser-based versions for cross-platform use.

- Advanced features

- Sobol sequences and importance sampling: available in Analytica and Analytic Solver.

- Metalog distributions: supported by Analytica, Analytic Solver, and ModelRisk.

- Copulas and advanced dependency modeling: strongest in ModelRisk.

- Performance and model complexity

- Analytica and GoldSim are better for large, dynamic models. Analytica is especially good for multidimensional models.

- They avoid Excel’s limitations and offer visual modeling interfaces with influence diagrams.

- Optimization capabilities

- @RISK: RiskOptimizer add-on with genetic algorithms.

- Analytic Solver and Analytica: wide range of linear, quadratic, and nonlinear optimizers.

- Budget and licensing

- Free or low-cost: ChanceCalc+ (education/free version) and Analytica (free up to 101 objects).

- Higher cost: @RISK and GoldSim are premium-priced with advanced support.

- Industry applications

- Finance and project risk: @RISK, Analytic Solver.

- Engineering and science: GoldSim.

- Broader risk management, energy, climate, policy: Analytica.

Key features of Monte Carlo simulation software

Summary:

- Most packages are Excel add-ins, though two stand-alone options run independently and typically work faster.

- All run on Windows; ChanceCalc also supports Excel for Macintosh, while Solver and Analytica offer browser-based versions.

- Core functionality includes Monte Carlo simulation with a wide range of probability distributions and visual outputs such as histograms, exceedance plots, tornado, and spider charts.

- Efficiency improvements are available through Latin Hypercube sampling, Sobol sequences (in select tools), and importance sampling for rare events.

Each package offers an extensive library of distributions, though users typically rely on a smaller set of common ones.

Type: Most are add-ins to Microsoft Excel. Two are stand-alone software packages that do not require other software. Stand-alone packages are typically faster since they don’t work via Excel.

Platform: All these products work on Windows OS. As far as we know, ChanceCalc is the only one that works on Macintosh, in Microsoft Excel for Macintosh. Frontline’s Solver, and Lumina’s Analytica also offer online versions you can access via most web browsers.

Tornado charts: Show the effect on a result of changing each uncertain input from a low to high value, holding all other inputs at their mid value. When arranged as a horizontal bar chart ordered from the highest effect to lowest, it looks a bit like a tornado. Another view is the spider chart, which plots the effect on the result based on percent changes of each input from low to high, making it look a bit like a spider.

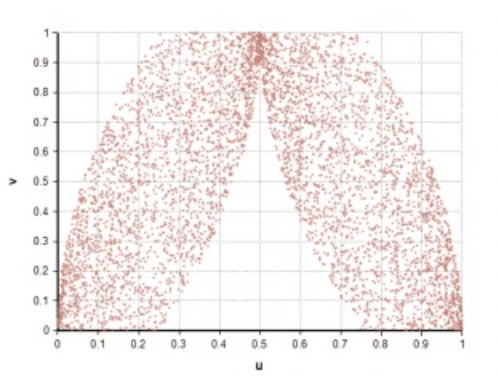

Basic Monte Carlo simulation: By definition, all these packages let you specify each uncertain variable by selecting from a large range of probability distributions. They generate a random sample of values from each one and propagate them through the model to obtain a corresponding random sample for each result of interest. They offer a variety of ways to view the resulting distributions, as histograms indicating probability density functions, cumulative probability functions, and often their reciprocal probability exceedance curve. Some let you see the underlying sample as a scatter plot.

Latin Hypercube sampling (LHS): A variant of Monte Carlo offered by some of these packages. It divides up each uncertain distribution into n equiprobable intervals, and uses a random value from each interval (or the median of each interval for median LHS). LHS is often more efficient (i.e. converges faster) than simple Monte Carlo, so estimates of means and percentiles are more accurate for a given sample size. In other cases, it performs similarly. Thus, it is sometimes much better and never worse. That is why some packages, such as @Risk and Analytica use LHS as the default method.

Sobol sequences: A quasi-Monte Carlo (QMC) method using low-discrepancy sequences to generate sample points that deterministically fill the multi-dimensional space as evenly as possible. Sobol sequences are not widely used, available only in Analytic Solver and Analytica. They usually converge faster than standard MC or LHS for moderate dimensions (up to about 15)–with computational complexity close to O(1/N), compared to O(1/√N) for MC and LHS. See comparing Monte Carlo, LHS, and Sobol methods.

Importance sampling: If you are simulating rare disasters (or successes), normal Monte Carlo requires a huge number of samples to get enough samples from these low-probability “tail events” to accurately estimate their probability and overall expected value. Importance sampling also known as “weighted sampling” can help out here in reducing the number of samples needed.. It overweights the extreme outcomes so that the Monte Carlo generates more samples in the areas of importance. It uses the inverse weight on those samples in the result so that resulting statistics will be unbiased.

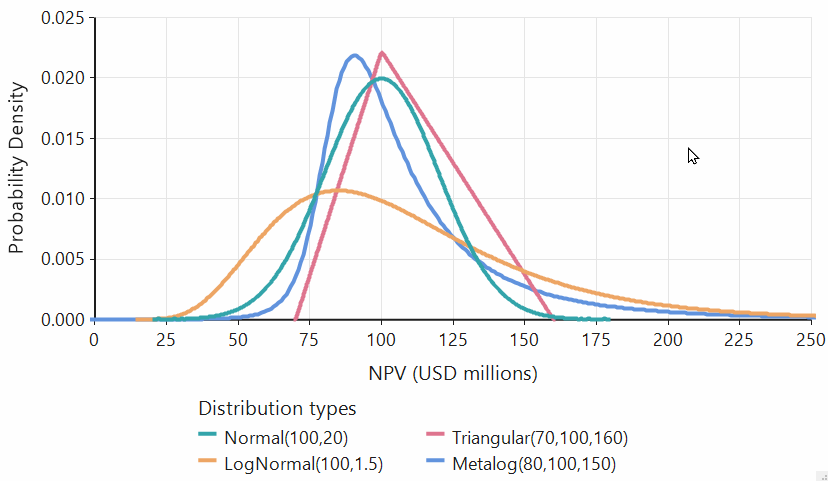

Probability distributions: All these packages offer at least 40 different discrete and continuous distributions, including standard named parametric distributions and custom distributions, to represent a wide variety of uncertainties. Some a great deal more. However, most users use only a small subset of most common distributions.

Metalog and distribution fitting: The metalog distribution, developed in recent years by Tom Keelin, is an extremely flexible family of continuous distributions that can fit unbounded and bounded quantities, with many common distributions as special cases including uniform, beta, normal, lognormal, Student-t, gamma, and more. It is useful for fitting distributions to expert elicitations and to sample data.

Dependencies, correlations, and copulas: These are methods to represent probabilistic relationships among variables, including a variety of multivariate distributions, correlation matrices, and copula structures. Most substantial applications have uncertain variables that are probabilistically dependent, so this is an important set of features.

SIPmath™ standards: “SIP” means a Stochastic Information Packet—that is, a random sample representing uncertainty about a quantity. The SIPmath standards specify file formats to store and exchange random sample data in a form that is actionable, arithmetical, and auditable with IDs to identify the variable and organization. The SIPmath 3.0 standard uses the HDR portable pseudo random number generator and the Metalog distribution to provide a very compact JSON representation.

Optimizer: Does the tool offer solvers or optimizers to find the decisions that maximize the objective under uncertainty as an option to work with the Monte Carlo simulation? “$” indicates that this costs extra where available.

A guide to selecting a Monte Carlo package

How should you use the information about the seven Monte Carlo packages summarized below to go about selecting the best one to meet your specific needs? Here are the key considerations to guide your choice:

- Existing spreadsheet use: If you primarily work within Excel and want to stay with its familiar interface or have existing spreadsheets to which you want to add Monte Carlo simulation, you should consider one of the five spreadsheet add-ins listed first.

- Platform Compatibility: All tools work in Windows OS. The spreadsheet add-ins work in Excel for Windows. If you want to run on a Macintosh, your only option is ChanceCalc+ that also works in Excel for Macintosh. Frontline’s Analytic Solver and Lumina’s Analytica offer web versions that run in browsers on any platform.

- Advanced Sampling and Distributions: If you require advanced features like Sobol sequences, Importance sampling, or Metalog distributions, Analytica and Analytic Solver offer strong support. ModelRisk also supports Metalog distributions and copulas.

- Model complexity and performance: For large and complex models where speed and flexibility are crucial and for systems dynamics models, standalone tools like Analytica and GoldSim offer more power and avoid Excel’s limitations. If you need to handle more than the two dimensions that you can easily manage in spreadsheets, Analytica’s Intelligent Arrays are particularly convenient.

- Clarity of model logic: Analytica and Goldsim stand out with their visual modeling interface using influence diagrams to enhance model transparency and auditability, especially for collaborative or high-stakes projects.

- Optimization: If your models have multiple decision variables which need optimization, @Risk offers RiskOptimizer as an add-on with genetic algorithms. Analytic Solver and Analytica (with its Optimizer edition) offer a wide range of solvers for linear, quadratic, and nonlinear optimization.

- Budget and Licensing: Most products offer a limited-time free trial to test them out. Many offer a discount for academic users. ChanceCalc+ and Analytica offer a free edition with no time limit for smaller applications.

- Application areas:. @Risk and Frontline’s Analytic Solver are widely used for finance and project risk management. Analytica is widely used for applications in risk management, energy, environment, and climate. Goldsim specializes in engineering and science applications. But all these tools can be and are used in many application areas and industries, so you should pay more attention to the other issues in selecting a tool to fit your needs.

Spreadsheet Add-Ins

@RISK (Lumivero, formerly Palisade)

@RISK is a widely used Excel add-in for Monte Carlo simulation. It adds a large library of probability distributions, correlation modeling tools, and scenario/sensitivity analysis features to Excel, enabling probabilistic modeling inside the spreadsheet environment. Users can run thousands of trials and examine outcome ranges, risk profiles, and Tornado charts.

Its integration with Excel means a minimal learning curve for spreadsheet users, though it can create heavy reliance on proprietary functions. It’s widely used in finance, engineering, and project risk assessment, and benefits from strong documentation and support resources.

Pros

- Extensive library of over 90 probability distributions.

- Clear reporting outputs, including Tornado and spider charts.

- Familiar interface for experienced Excel users

Cons

- No support for Metalog distributions or SIPmath standard.

- Models use proprietary functions, making them less portable.

- Higher licensing cost than some competitors.

Price: $2,900/year Professional edition; $3,500 Industrial edition

Website: https://www.lumivero.com

Analytic Solver (Frontline Systems)

Analytic Solver is a powerful Excel add-in from Frontline Systems that merges Monte Carlo simulation with optimization, forecasting, and decision trees. It supports standard Monte Carlo, Latin Hypercube, and other sampling methods, plus advanced correlation structures. It’s one of the few spreadsheet add-ins that support Metalog distributions and the SIPmath standard, making it easier to share simulation results without an add-in.

While it offers a broad technical toolkit, the interface can feel more complex than other add-ins. Some advanced features require a learning curve. Its integration with optimization is ideal for scenarios where you want not only to quantify uncertainty but also to find the best decision under uncertainty.

Pros:

- Powerful built-in optimization capabilities alongside simulation.

- Supports Metalog distributions and SIPmath standard.

- Flexible sampling methods, including Latin Hypercube.

- Converts spreadsheet formulas into RSON language to allow them to run online.

- 15-day free trial of full functionality

Cons:

- Distribution library is smaller than @RISK’s.

- Steeper learning curve for new users.

- Premium pricing for full features.

Price: ~$1,767/year; ~$5,300 for 3-year license.

Website: https://www.solver.com

ChanceCalc+ (ProbabilityManagement.org)

You use ChanceCalc+ to create Monte Carlo simulation in Excel models, but unlike the other Excel add-ins, once you don’t need it to run the models after you’ve created them. Models created with ChanceCalc+ can perform hundreds or thousands of simulation trials per key-stroke using the built-in Data Table function. It lets you store results in stochastic libraries as CSV files, or in the open SIPmath™ 2.0 or 3.0 Standard.. It has separate tabs for Monte Carlo generation of 18 distributions and for importing Metalog Distributions from Tom Keelin’s Metalog Templates. Open-source files are provided and a ready to run install package is available for purchase.

ChanceCalc+ is especially useful when sharing models with non-technical audiences or when compliance demands auditability. However, it lacks some of the automation and visualization features of commercial add-ins.

Pros:

- After you have built simulations using the ChanceCalc add-in, you can run and share them in native Excel without requiring the add-in.

- Interactive, performs thousands of trials per keystroke

- Fully supports Metalog distributions.

- Reads and writes stochastic data in SIPmath standard 2.0 and 3.0

- Uniquely among these products runs on Macintosh as well as Windows.

- Free or low-cost option for small teams.

Cons:

- Currently in beta testing.

- Fewer built-in analytical and visualization tools, such as sensitivity analysis or tornado charts,.

Price: Free for education; $1,500 one-time for full ChanceCalc+.

Website: https://www.probabilitymanagement.org/chancecalc

ModelRisk (Vose Software)

ModelRisk is a technically advanced Excel add-in designed for professional risk analysts who need flexibility and depth. It supports hundreds of probability distributions, user-defined distributions, copulas, and advanced statistical fitting. It includes time-series simulation, stress-testing tools, and multiple sampling techniques.

Its interface is Excel-based but geared toward more technical users. While its market share is smaller than @RISK’s, it often wins on technical breadth for the price.

Pros:

- Very large and versatile distribution library.

- Supports copulas, time-series, and advanced dependency modeling.

- Better price-to-feature ratio than @RISK.

Cons:

- Does not provide Latin hypercube sampling.

- Less brand recognition than @RISK.

- Interface less polished than some competitors.

- Model migration from @RISK can require manual adjustments.

Price: ~$1,300–$1,400/year; ~$4,000 for 3 years.

Website: https://www.vosesoftware.com

Oracle Crystal Ball

Crystal Ball is Oracle’s Excel-based Monte Carlo simulation tool, combining risk analysis, forecasting, and optimization through its OptQuest module. It is designed to integrate cleanly with existing spreadsheets, leaving formulas untouched while enabling “what-if” analyses with probability distributions. It’s user-friendly and suitable for business analysts who want fast insights, but it lacks newer features such as Metalogs and SIPmath support.

Its development pace has slowed since Oracle acquired it, but it remains a stable, well-documented product.

Pros:

- Simple integration without altering spreadsheet structure.

- Includes OptQuest optimization engine.

- Accessible interface for business users.

Cons:

- Not available for new users, support for legacy users only

- No support for Metalogs or SIPmath.

- Limited advanced statistical features.

Price: ~$995 (Standard); ~$2,200 (Suite with optimizer).

Website: https://www.oracle.com

Standalone tools for Monte Carlo simulation

Analytica (Lumina Decision Systems)

Analytica is a visual modeling environment for decision analysis and simulation. Instead of building models in spreadsheet cells, users build models by drawing influence diagrams which identify chance variables, decisions, objectives, constraints, and other types of variable. It supports Monte Carlo simulation with Latin Hypercube and Sobol sampling as well as weighted sampling for importance sampling. Analytica’s array abstraction lets you run calculations over multidimensional data without reshaping arrays, making it more flexible and powerful than spreadsheets.

It’s well-suited for business, policy, and technical decision-making and risk management, especially for organizations concerned about model transparency and explainability. Its unique features are its influence diagrams and Intelligent Arrays.

Pros:

- Visual modeling interface using influence diagrams improves model transparency.

- Supports Metalogs, including a new method to ensure feasibility.

- Supports advanced sampling methods, including Sobol sequences and importance sampling

- Intelligent Arrays handle multidimensional data naturally without manual reshaping.

- Dynamic simulation for models changing over time with feedback loops.

- Analytica Professional, with full Monte Carlo simulation and related methods, is the least expensive of these products.

- Integrates directly with Excel spreadsheets and other business applications, using CSV files, XML, JSON, relational databases, Python libraries, and web services

- Deploys models as web applications via Analytica Cloud Platform.

Cons:

- Requires learning a new modeling paradigm.

- Smaller user base than Excel add-ins.

Annual subscription price: Free Analytica up to 101 objects, no time limit $0; Annual licenses Professional $1,000; Developer: $2,000; Optimizer $4,000.

Website: https://analytica.com

GoldSim (GoldSim Technology Group)

GoldSim is a high-end dynamic simulation platform combining system dynamics, discrete events, and Monte Carlo simulation. It excels at modeling time-evolving systems such as infrastructure, environmental systems, and reliability scenarios.

Modules add features like contaminant transport or financial analysis. GoldSim supports multiple sampling strategies and can run simulations in parallel for speed. Its flexibility comes at the cost of a steep learning curve and a high price point, making it best for engineering and scientific applications.

Pros:

- Visual modeling interface using influence diagrams improves model transparency.

- Powerful for time-based and complex system simulations.

- Modular structure tailors features to industry needs.

- Supports importance sampling.

- Parallel simulation capability.

Cons:

- Expensive for smaller projects

- Complex for simple risk analyses.

- Limited adoption outside engineering-heavy fields.

Price: $2,750 annual subscription. $5,750 perpetual license.

Website: https://www.goldsim.com

Is this comparison objective?

This comparison review was written by Monte Carlo experts at Lumina Decision Systems, the makers of Analytica. We recognize that Analytica isn’t for everyone. We want you to select the tool that best meets your needs, so we have tried to be as objective as possible. If you notice anything inaccurate or biased, please let us know at [email protected], so that we can correct it.

FAQ

What are the top Monte Carlo simulation software options for businesses looking to improve financial risk analysis and investment analysis?

Any of these packages could be used for financial applications with risk and uncertainty analysis. For financial applications with proper treatment of probabilistic dependencies — such as correlated investments and dependence over time—you might consider Analytic Solver, @Risk, ModelRisk for spreadsheet add-ins. For more sophisticated analysis that handles multiple dimensions, such as time, investment projects, portfolios, and scenarios, Analytica may be most convenient.

How do leading Monte Carlo simulation software platforms compare in terms of integration with Excel and other business applications?

The five spreadsheet plug-ins, Analytic Solver, @Risk, ModelRisk, Crystal Ball, and ChanceCalc are directly integrated into Excel. ChanceCalc+ has the advantage that, once you have created a probabilistic model in Excel, you can run and share it even without the ChanceCal+ add-in. Although Analytica can run stand-alone without Excel, it offers extensive features to read from and write to Excel spreadsheets, as well as integrate with other business applications via web CSV files, XML, JSON, relational databases, Python, and web services.

What should you consider when choosing Monte Carlo simulation software for portfolio management?

To analyze and manage a small portfolio of projects or investments, any of the spreadsheet add-ins would be appropriate. To manage dependencies among projects, you need one that supports probabilistic dependencies. For a larger portfolio, or projects with varying model structure, Analytica may be more convenient.

What should you consider for scientific and engineering applications with uncertainty?

For complex dynamic systems, whether physical or economic, Goldsim and Analytica, both explicitly designed to integrate Monte Carlo with system dynamics, are the most suitable packages.

What software best supports transparency in Monte Carlo simulation modeling?

Spreadsheets are transparent in that they are widely understood, but their cell references and complex formulas repeated for each element of a table can make them quite obscure. Analytica and Goldsim both offer influence diagrams as a clear visual display of the key variables and their relationships, Analytica’s Intelligent Array formulas make it especially clear for representing operations on multidimensional arrays.