Decision analytics

Information to improve your decisions

It’s one thing to invest in analytics and business intelligence. But analytics yield no value until they’re used to improve decisions – hence the importance of what we call decision analytics.

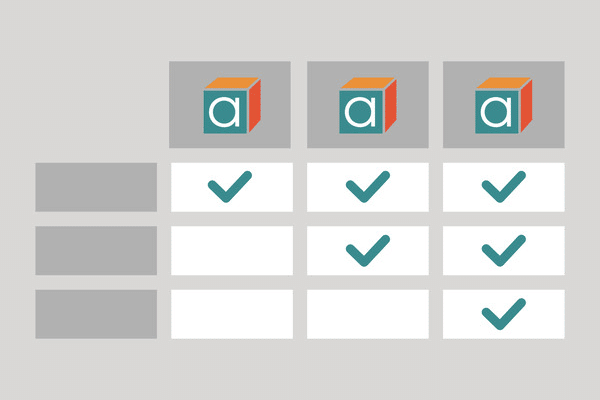

Descriptive analytics or past data

Most analytics function like a turbo-charged rearview mirror–great for looking into the past, but ultimately, only part of the picture. Descriptive analytics can yield useful insights, like capturing detailed customer and market data or summarizing data, but they are limited to understanding situations that have already occurred.

Predictive analytics or possible futures

The next step is using analytics like a GPS–looking at what the data says about the future. Companies can apply statistical forecasting methods to extrapolate trends from historical data. For example, estimating future demand and projecting changes in markets. These results can yield more value to help the company visualize possible futures. But this information is not yet actionable.

Decision analytics

The ultimate goal is to use the insights from the data to take action – to take the wheel and steer your organization in a more profitable direction.

To make this practical, you need tools that focus on key business decisions; to allocate marketing dollars, set prices, enter new markets, design new products, and plan for capacity. Descriptive and predictive analytics are essential, but they don’t take you the whole way. You likely need to combine the data and forecasts into a model to see the return on investment (ROI) to clarify the costs and benefits of your options.

When you drive through the fog of uncertainty, exploration of alternative scenarios and probabilistic risks let you discover robust and flexible decisions. For complex decisions, you may need optimization tools to find the most rewarding strategies.

Data vs. judgment

It’s tempting to substitute data for judgment in business decisions. Certainly, large quantities of data, along with powerful analytic tools, can improve the information available for effective decisions.

But even when we have plenty of data, our sophisticated tools won’t eliminate uncertainty. Markets are increasingly volatile–the competitive landscape evolves rapidly, customers migrate, new markets appear, and new technologies replace old ones.

Insights from data are not enough. The intuition and judgment of experienced executives, sales managers, and market analysts are also necessary. You need tools that let you combine the most informative descriptive and predictive analytics with the expert judgment of your team members.

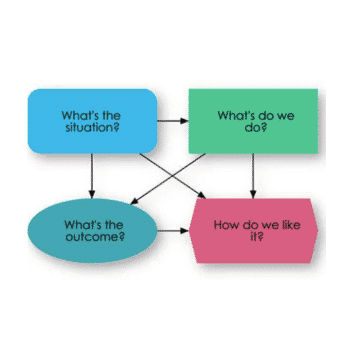

Using Analytica to perfect your decision analytic skills

Lumina has specialized in decision analytics since it was founded in 1991. Analytica was designed to help decision makers navigate the decision analytics landscape with ease and flexibility. This is done through influence diagrams which provide a visual way to build and navigate models. The models allow you to clearly distinguish decisions, objectives, data, and uncertain variables. Analytica offers intelligent forecasting methods with stepwise regression to find the most informative predictors automatically. It integrates Monte Carlo simulation to treat risk and uncertainty. Scenario and sensitivity analysis help you find out what matters and why.

Author