Earthquakes, like hurricanes, terrorist attacks, oil spills, and even financial meltdowns, are extreme events for which it is difficult to predict their probability and severity.

Earthquakes, like hurricanes, terrorist attacks, oil spills, and even financial meltdowns, are extreme events for which it is difficult to predict their probability and severity.

Their effects depend on many uncertain variables. Yet corporations and governments all need to estimate these risks and decide whether and how much insurance is appropriate.

Decision tools to assess these risks and select risk management strategies can be profoundly challenging to create.

Certus Consulting has used Analytica for more than five years to develop sophisticated models that help their clients make sense of earthquake risks and develop practical, cost-effective, risk management strategies for the short and long term. Here is an example of one such effort.

The challenge

A county in the San Francisco Bay Area sits on a major fault. It spends over $1 million per year to insure its buildings against earthquake losses. Several years ago, it decided to insure 50 of the over 500 buildings it owns or leases without any formal risk study.

The county wanted to understand the extent of its seismic risks and to optimize its insurance budget : More specifically

- What overall monetary risk does it face from earthquakes?

- Is it insuring the right portfolio of buildings?

Answering these questions was an important first step for the county to optimize its annual budget and to develop a long-term management strategy.

Classic Probable Maximum Loss or “PML” models used by insurance companies and brokers are typically too general to produce a detailed assessment of a client’s risks. They are used primarily as an underwriting tool to set rates. They produce a very narrow set of information usable for that purpose. Individual buildings have unique characteristics that affect their seismic performance. In the aggregate, when insurance portfolios consist of tens of thousands of buildings, the performance of any single building is of little importance.

However, to a client with a much smaller portfolio, the individual risk of one building can have a significant impact on losses. Also, PML models typically ignore the cost of lost business operations, which is often not insured, yet can be a considerable portion of a client’s total risk.

The county, therefore, required a customized risk and loss modeling tool to:

- Model the unique characteristics of each property in the county’s portfolio,

- Consider loss of contents and business interruption as well as capital losses,

- Calculate losses at a range of confidence levels on an annualized and scenario basis,

- Compare the relative risks among buildings to determine which are most worth insuring given budgetary limits, and

- Consider a range of insurance deductibles and limits, based on the risk exposure over time.

Why Analytica?

Certus Consulting, Inc. is a leader in the seismic evaluation of buildings. Our principals are structural engineers with more than two decades of experience in building modeling, seismic hazard analysis and loss estimation. Previous to using Analytica, our principals primarily used single building loss modeling tools employing spreadsheets or coded software. Once we began using Analytica in 2004, however, our ability to develop complex and highly useful models grew quickly.

According to Certus: “Analytica was especially suited for this project: The highly probabilistic and uncertain nature of earthquake hazards, building performance and loss estimation makes a purely numerical solution impossible. No global equations can be drawn up to estimate portfolio losses, contributions of risk by individual buildings or optimization strategies. Many variables interact in complex and dynamic ways. Therefore, Analytica’s simulation based capability — the ability to run large, multi-variable Monte Carlo simulations — was absolutely necessary to help us answer the county’s questions.”

“The model also had to be scalable in many dimensions. Indexes of variables, such as the portfolio composition or the earthquake scenarios considered, had to be expandable to increase the comprehensiveness of the study. Equally important, the number of different variables considered in the analysis also had to be flexible. The ability to easily add new indices, which increases exponentially the size and complexity of the model, was important to achieve greater insight and refinement.”

The solution

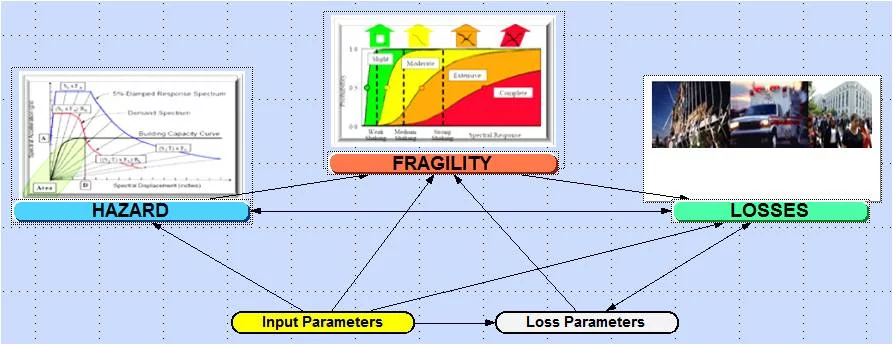

Certus created a model for the county based on engineering and loss estimation research over the past two decades through nationally funded projects. The effort combined engineering analysis of the buildings in the portfolio with site-specific earthquake hazard information for the region, information on repair and business interruption exposures, and standard insurance financial processes.

Certus incorporated uncertainty into several important variables. The Analytica model used a large Monte Carlo simulation approach with over 100,000 iterations to obtain not only average estimates of loss, but expected losses at a range of confidence levels.

Information on building size, structural type, specific structural deficiencies, and soil properties were among the data included in the model to provide a high level of accuracy and detail.

Among the results Certus obtained from the model were estimates of the county’s exposure as a function of the size of the insured portfolio, insurance deductibles and limits, and confidence level.

Certus considered several possible earthquake scenarios and evaluated annual probabilities of suffering a range of losses. They were able to identify the most significant risk contributors in the portfolio.

For each building, they compared the earthquake insurance premiums being charged by the county’s broker, with a refined estimate of “risk adjusted premium” based on the more detailed structural information used in the model.

Thus, Certus was able to identify several buildings that were being insured at rates higher or lower than appropriate given their actual risk. Given this information, the county can refine its insured portfolio to optimize its premium dollars spent. It can also incorporate its overall capital and business interruption exposure and risk into a comprehensive enterprise risk management program. In this way, the county can develop an effective long-term risk management strategy.

Next, he imported historic precipitation levels and used Analytica’s built-in Monte Carlo analysis to examine probabilistic future rainfall scenarios.

Finally, Nieman developed supply scenarios to explore the possible effects of climate change – both decreased and increased rainfall – and to forecast potential water demand based on alternative assumptions about growth, conservation, and the use of recycled water.

The author

Evan Reis

Certus Consulting