The challenge

Firms face three challenges in developing their ESG strategy. They need to:

- be more transparent in how they quantify their ESG goals.

- estimate the cost-effectiveness of projects in supporting these goals.

- design and manage a portfolio of projects to maximize achievement of ESG goals for a limited budget.

One thing that makes it especially challenging to select a portfolio is that projects may interact in their costs and effects. For example, the effectiveness of switching from natural gas to electricity for heating buildings or for industrial processes depends on the generation or purchase of low-carbon electricity.

To meet these needs, firms need a unified ESG portfolio planning tool. It must assess the cumulative impact of ESG initiatives across the organization. It requires proven transparent modeling capability with easy-to-use portfolio-level aggregation and visualization. It should update rapidly as new data on project status and ESG impacts become available. And it should provide a dashboard to give immediate insights into opportunities and progress for individual projects and for the entire portfolio.

Why Analytica?

“Bicore selected Analytica for its modeling capability and ease of integration. The graphical modeling language with influence diagrams nicely matches thinking about sustainability impacts. For example, it models how a project delay affects timing of its energy savings downstream and hence progress to zero emission targets. Its support for interactive model development lets us build understanding in the models and gain confidence. Its speed of computation and convenient interaction with ADE API allows real-time recalculation as users change assumptions and new data arrives. This fast feedback is essential for portfolio planning success.”

– Jac Goorden, CTO and Cofounder, Bicore

The solution

FLIGHTMAP ESG is unique in its combination of modeling power to provide the latest insights, transparency to show the key data and assumptions, and a multi-criteria decision framework to manage a comprehensive set of ESG goals for a large portfolio of initiatives. An early adopter of FLIGHTMAP ESG already saved about €50,000 simply by aligning their energy transition, greenhouse gas reduction, and product innovation portfolios in a single roadmap, by eliminating data management overlap, inconsistency, and software redundancy.

Bicore develops and implements portfolio management solutions for a wide range of innovative organizations in Europe, built on its web-based FLIGHTMAP software platform. FLIGHTMAP uses Analytica to develop, review, and deploy models to assess the business prospects of research and development projects and initiatives. Several clients asked to include ESG criteria in their portfolio strategy. So Bicore has added a range of powerful yet transparent models to evaluate the sustainability and other ESG impacts of projects. These models expand with new data and insights from advances in technology, data, and regulations to support an agile portfolio planning process.

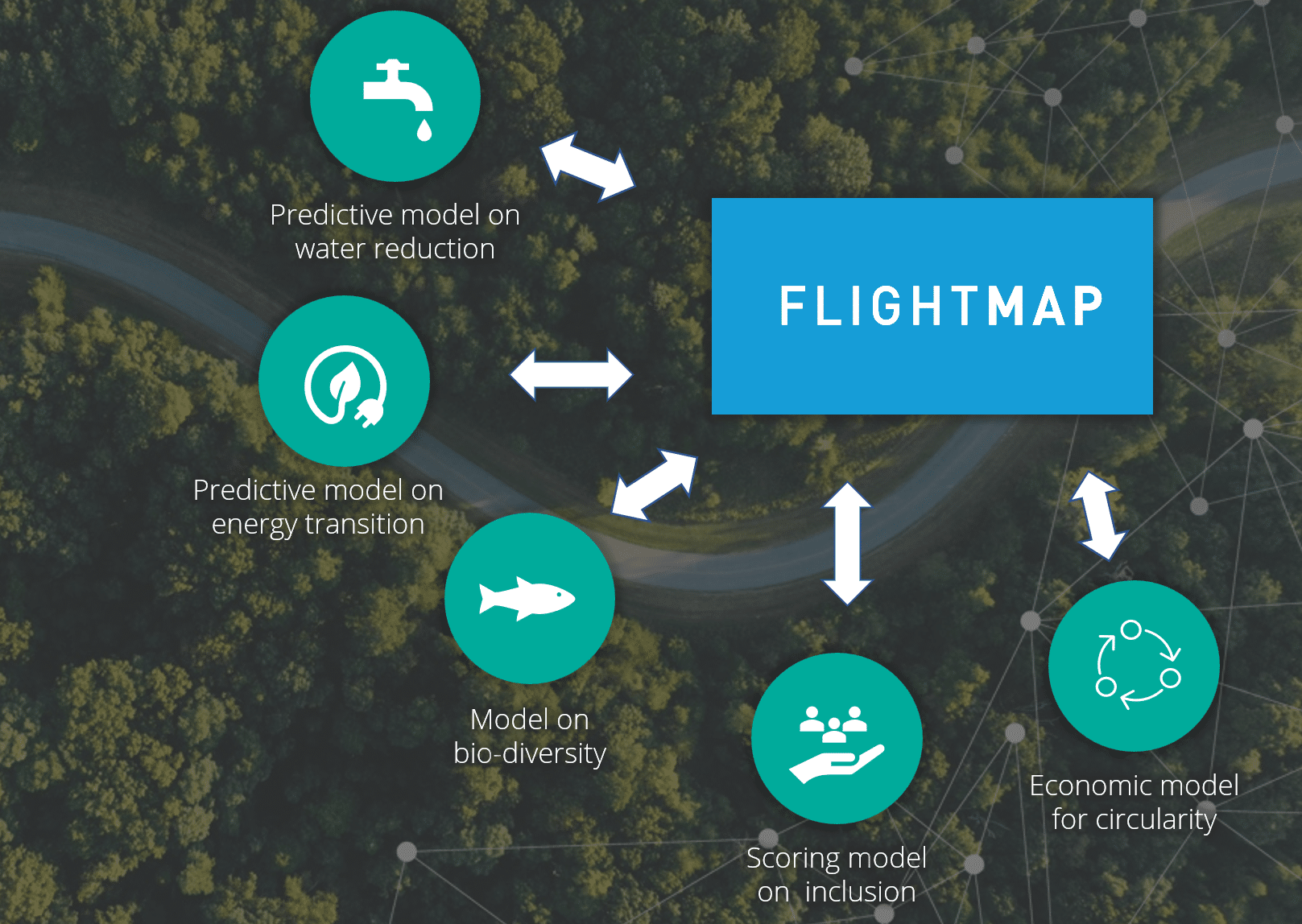

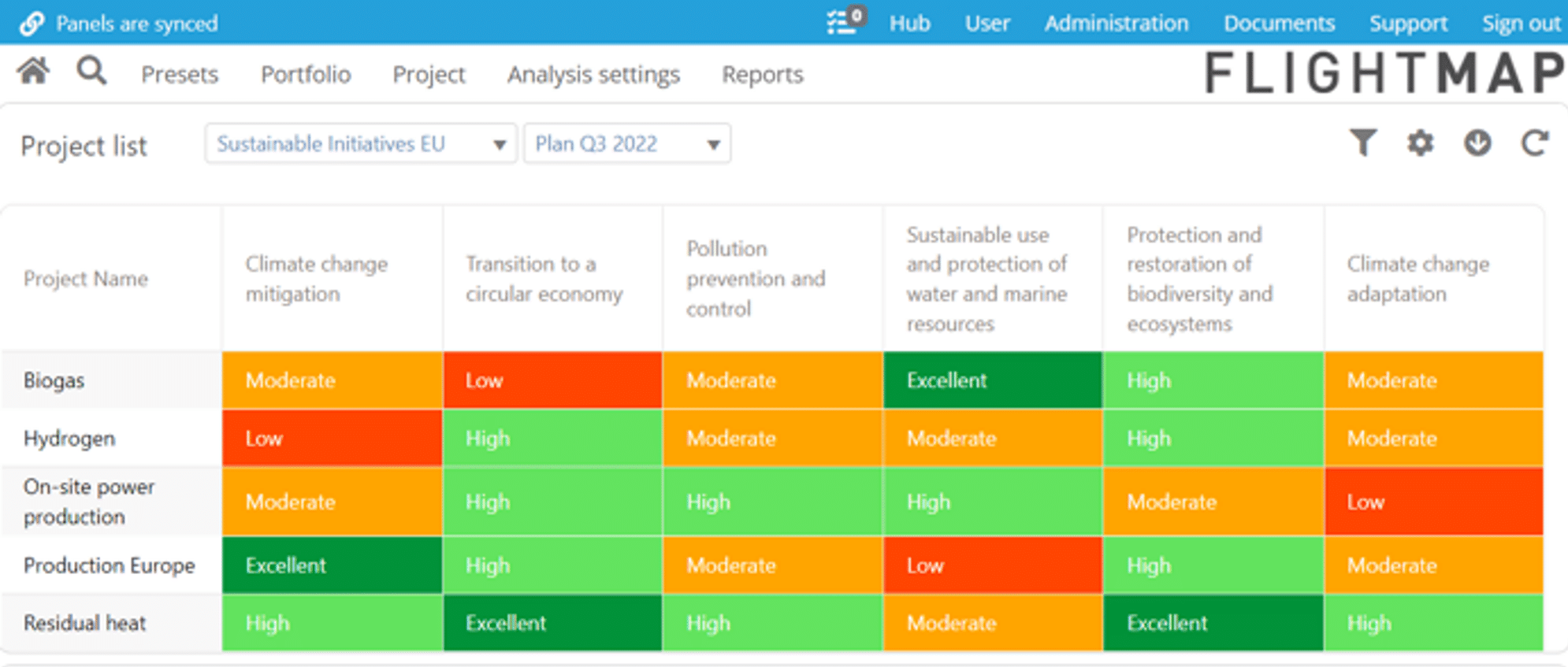

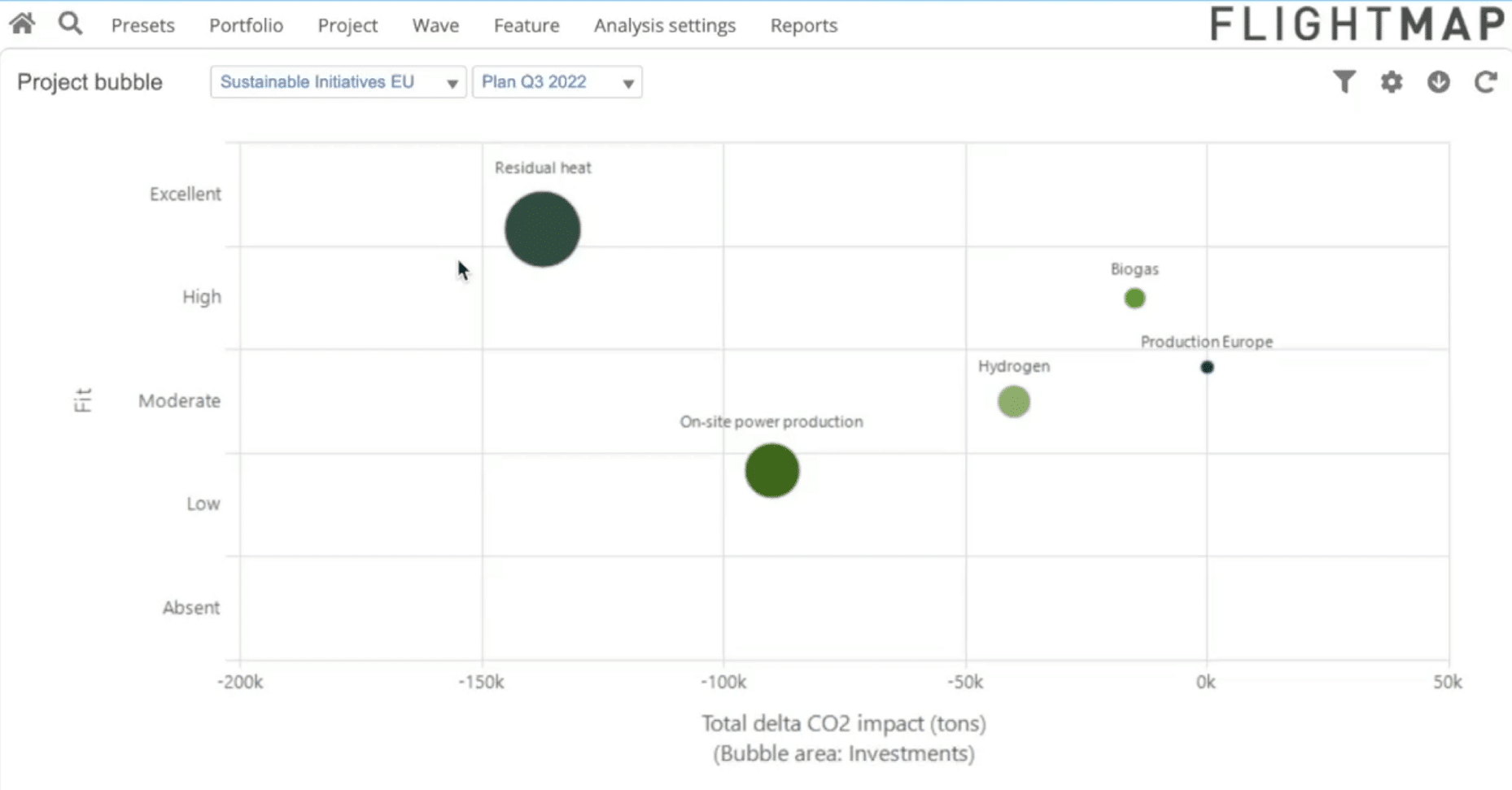

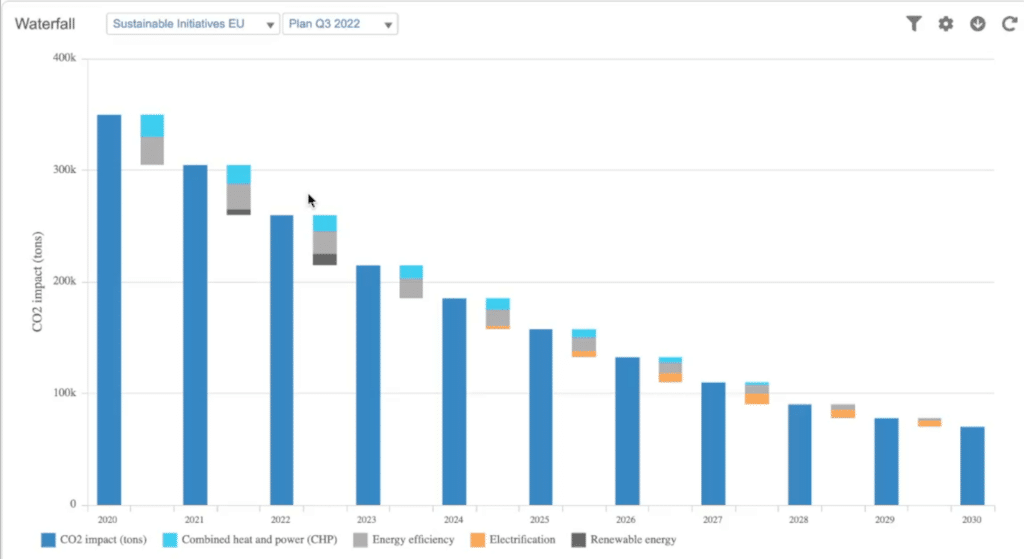

Flightmap ESG provides a full range of dashboards to help evaluate, select, and track ESG initiatives over a full range of criteria, including carbon emissions, and cost-effectiveness. It integrates predictive models on the energy transition, water reduction, biodiversity, contribution to a circular economy, and more. It helps managers develop long-range roadmaps to define and assess ESG strategies over time and their effectiveness in meeting key targets.

Flightmap ESG is an extension of Flightmap, which is widely used by large organizations to manage their portfolios for research and development, and product development projects. Flightmap is developed in Analytica and deployed on servers using the Analytica Decision Engine (ADE).

Authors

Key designers of FlightMap ESG include Bob Smeets, Product Manager, Jac Goorden, Cofounder of the Bicore Group, headquartered in Eindhoven, Netherlands. Flightmap ESG is deployed in North America in collaboration with Lumina.

For more

To learn more about Flightmap ESG, please contact Bob Smeets ([email protected]) or James Milford ([email protected]). Or head to the Flightmap ESG page.