This model introduces two Analytica modules for implementing strategy tables and multi-attribute utility theory in the software.

The challenge

Company executives, sustainability leaders, procurement professionals, and energy managers are finding energy procurement ever more challenging. Many companies do not have an adequate decision framework at the facility or regional level, let alone for broader strategic initiatives and objectives.

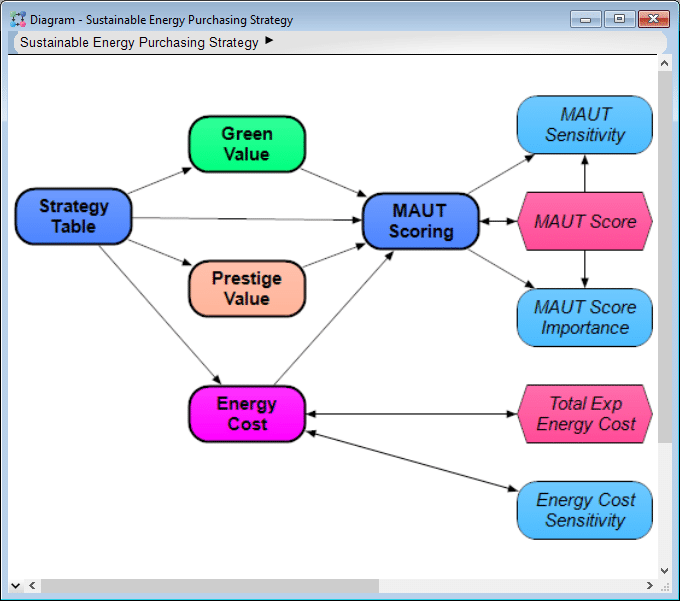

Donald Jenkins and Jeffrey Keisler at the University of Massachusetts built a multi-criteria model using Analytica to help global companies make these complex decisions. Their model combines calculated and judgment-based metrics for both environmental and business considerations. They built two new reusable modules, for multi-attribute utility and for decision analytic strategy tables. Then they applied the model to a multinational company. It uses a stochastic framework with Monte Carlo simulation to manage the inevitable uncertainties. The model can be applied to energy purchasing decisions for similar organizations.

Why Analytica?

The authors considered using a spreadsheet for this project. Alternatively, they could have used a programming language for the heavy lifting of the model’s array mathematics and simulation. But that would result in a black box that the decision maker might not trust or fully understand how they came to a specific conclusion.

They decided that Analytica’s influence diagrams would allow them to work together with experts, users, and decision makers more smoothly and with fewer errors. They liked Analytica’s rich quantitative modeling environment. It posed an initial learning curve—specifying models takes time beyond creating the visual representation. Nevertheless, they found it well-documented and well-supported. They found its object-oriented approach, indexing of arrays, and visual outputs made it simpler to walk through the model and explain how it works to non-technical decision makers and stakeholders.

The solution

The authors worked with a US Energy Services company that helps guide organizations through the complicated process of developing and executing sustainable energy purchasing strategies. They talked with the facilitator of a global company operating in Mexico.They used the energy advisor’s general framework to evaluate the energy purchaser’s needs. They created a more structured approach to concisely capture, analyze, and communicate strategic options and outcomes for decision makers. Donald and Jeffery populated the model with applicable historical energy usage data from the global company. This analysis helped clarify the customer’s priorities and guide them to a more informed decision.

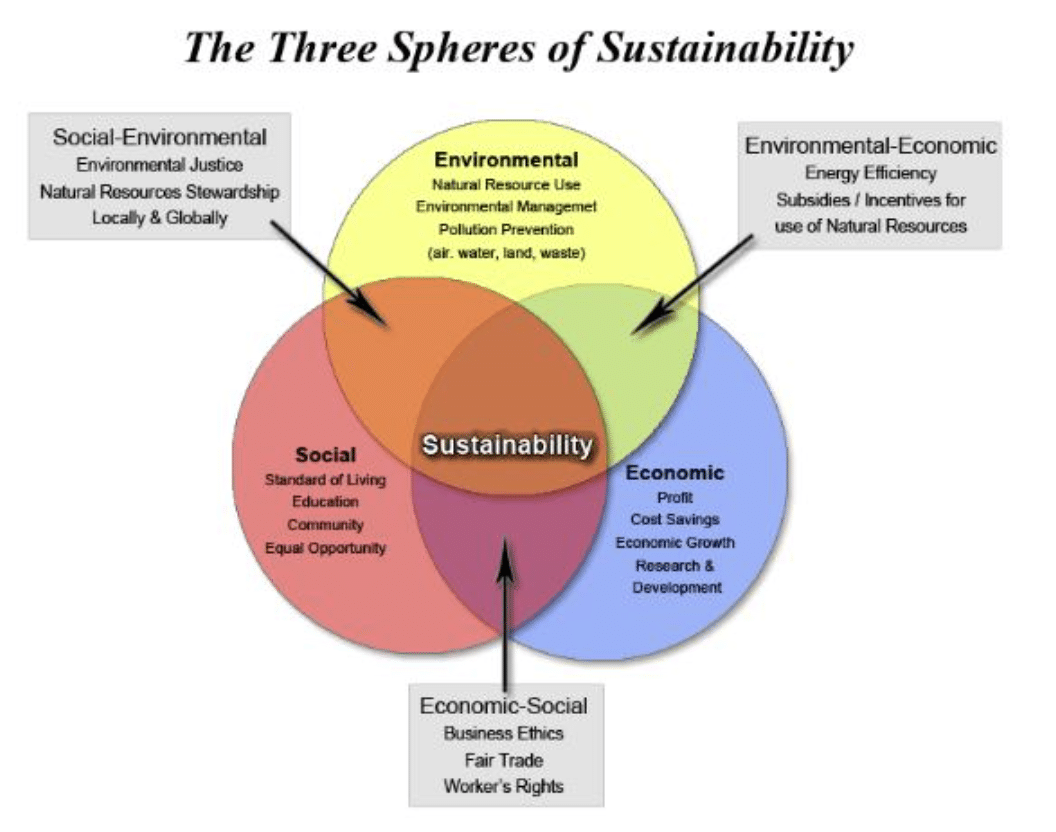

The model highlights three key attributes that come into play when selecting a strategy for procuring electricity:

- Energy Cost captures the expected electricity costs. Elements include energy usage, electricity rates, demand charges, potential cost to build on-site generation, renewable energy credits, and other associated costs. This module provides expected costs in absolute and normalized values.

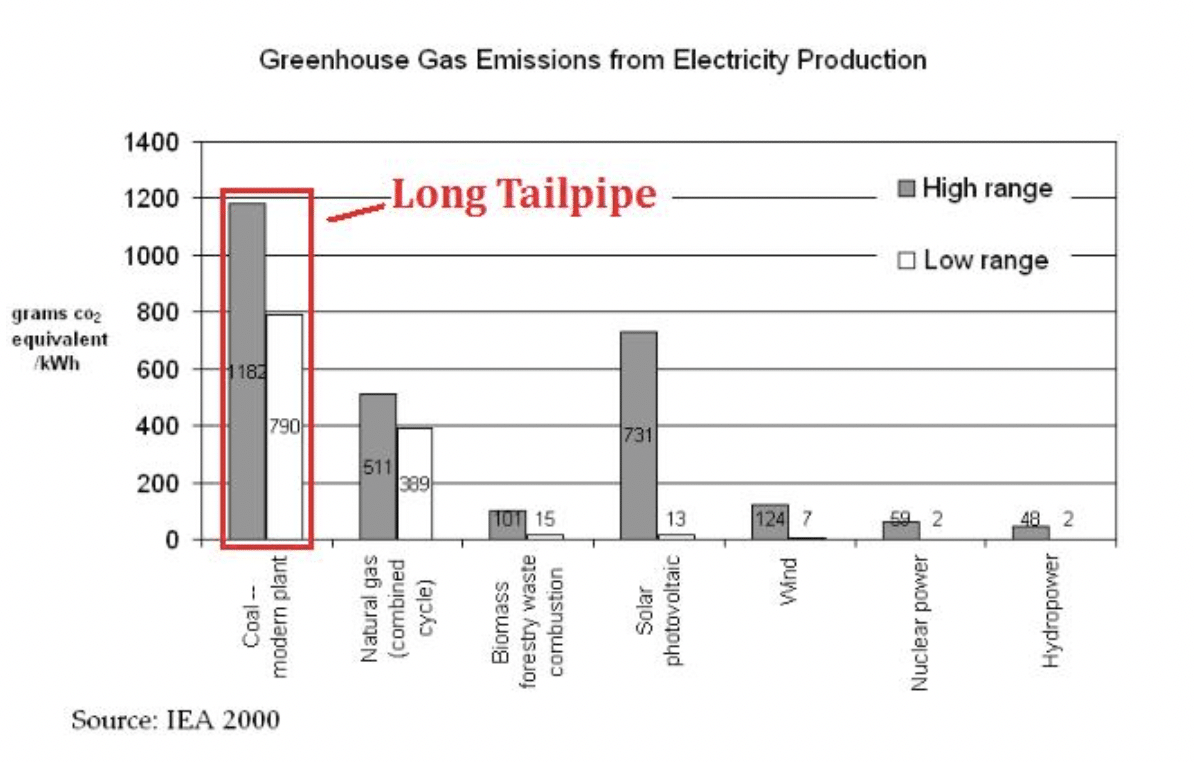

- Green Value captures the value to the organization for using sustainable energy. They assessed utility to the organization directly.This module could also include quantitative calculations of greenhouse gas reductions and other science-based goals.

- Prestige Value (or brand) captures the value to the organization for being seen as leader in sustainability. It uses a direct assessment of utility. It could also include a quantitative market analysis or ROI calculation for the organization.

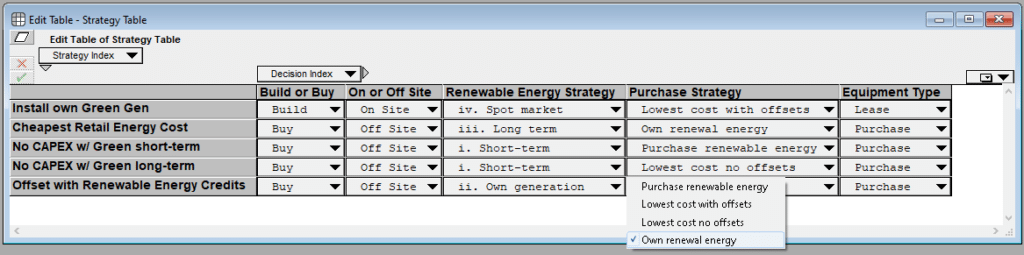

The analysts synthesized five key strategic options:

- Install Own Green Generation

- Cheapest Retail Energy

- No Capital Expenditures (CAPEX), with Green Short-term

- No Capital Expenditures (CAPEX), with Green Long-term

- Offset with Renewable Energy Credits

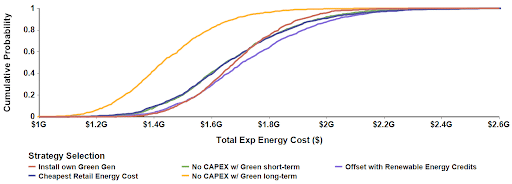

Using the Monte Carlo functionality of Analytica, they created cumulative distributions to visualize the uncertainty of Total Costs over 20 years. The graph shows that Option 4, No CAPEX with Green Long-term, is the clear winner pertaining to costs.

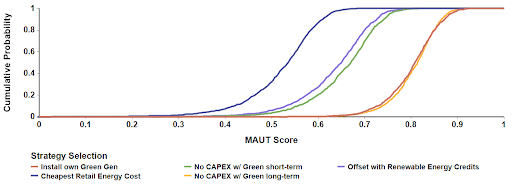

The situation changes when evaluating strategies on utility, combining Energy Cost, Green Value, and Prestige Value. They found two “best” candidates with similar results: No CAPEX with Green Long-term purchasing and Install Own Green Gens. Another clear takeaway is that the Cheapest Retail Energy solution falls clearly behind all other options due to its limited contribution to green and brand value.

It is worth noting that these results only apply to this project. The method might give different results in other situations.

Beyond this specific application, this model demonstrates the potential for multiple-criteria decision analysis (MCDA) modelers to use Analytica software’s rich scientific and financial modeling environment. In particular, Analytica’s modular capability makes it straightforward to connect strategic MCDA methods with modeling activities associated with building decision-support tools (e.g., visualizations, simulations, array calculations, probability distributions).

Authors

Donald J. Jenkins

University of Massachusetts

Management Science and Information Systems Department

Jeffrey M. Keisler, PhD

University of Massachusetts

Management Science and Information Systems Department

The customer

This case study was based on a consultation with an energy services company that employs 1,600 people in the US, supporting a global company operating in dozens of countries with more than 35,000 employees worldwide. The customer prefers to remain anonymous.

For more

The Analytica model for the full case study as well as the two generic modules built for the Strategy Table and Multi-attribute Utility Theory implementation.

The published paper in Environment Systems and Decisions.