Embrace risk & uncertainty

We face ever more risks: the pandemic, economic volatility, cyber attacks, and climate change, to name but a few. It’s tempting to emulate the proverbial ostrich and pretend the risks aren’t there, and use a single ‘best estimate’ for each uncertain assumption.

But if we don’t face risk and uncertainty, how can we figure out which threats are critical, and how to avoid or reduce them? Explicit treatment of uncertainty helps us quantify and manage risks. It shows us where it will be most valuable to get more data or expand our model. And it lets us find resilient strategies that let us prosper in a wide range of possible futures.

As an analyst, you may find it a challenge to treat uncertainty in your models. If you use spreadsheets, you have to buy a clumsy Monte Carlo add-in as a retrofit. We designed Analytica from inception to make it easy to embrace risk and uncertainty.

“Within its chosen domain — uncertainty propagation through influence diagram models — Analytica is by far the easiest and best tool that we have seen.”

Tony Cox,

PhD, J. of Human and Environmental Risk Assessment

Manage uncertainty: sensitivity, scenarios, and probabilities

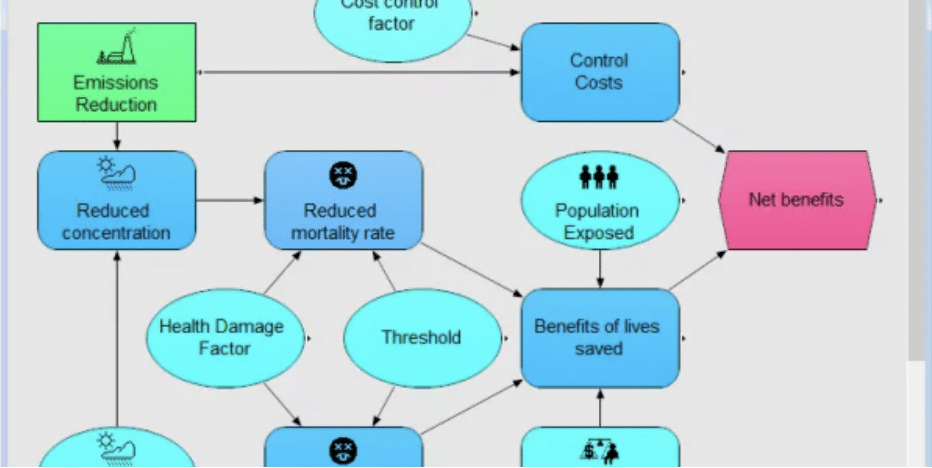

Suppose you are building a business model. Uncertainty is unavoidable in key assumptions, like future interest rates, costs, and sales. Analytica offers a comprehensive range of tools for working with all kinds of uncertainty:

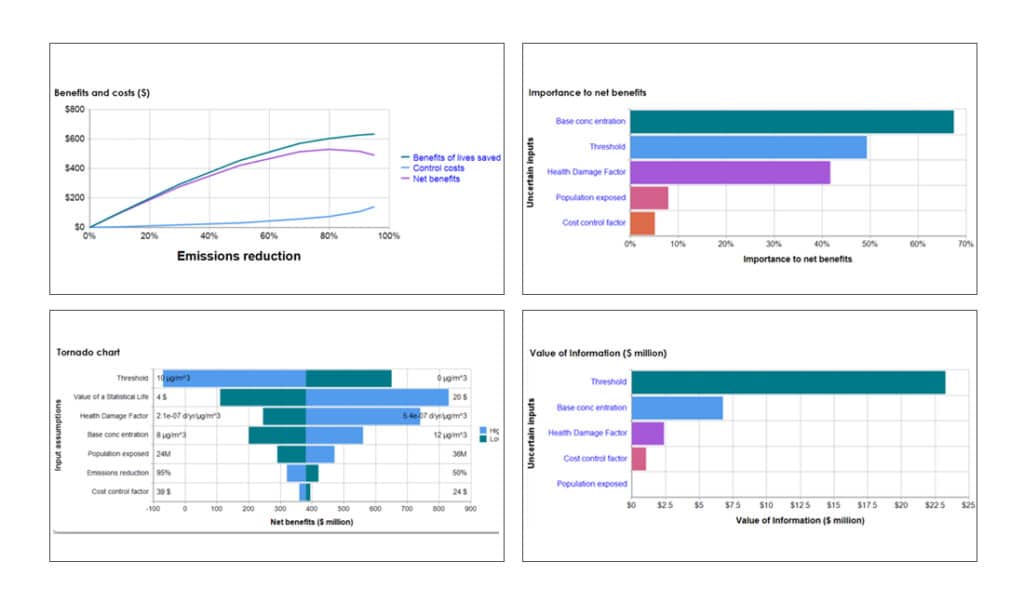

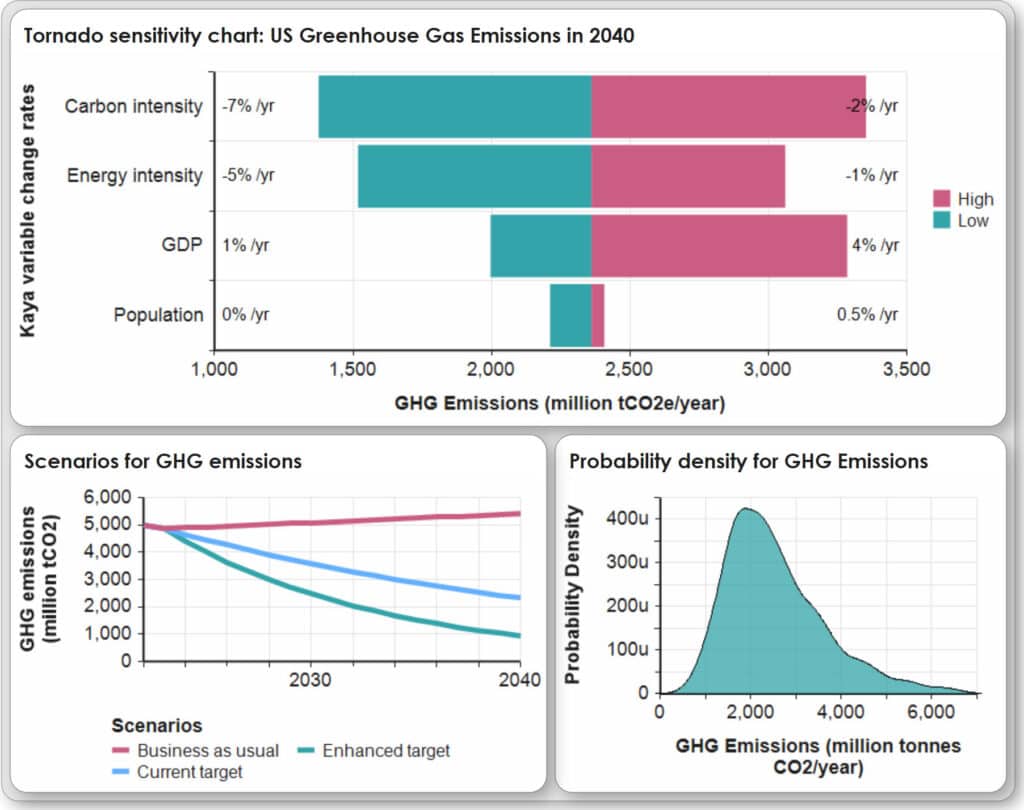

- Sensitivity analysis: Start by estimating a low and high plausible value for key variables. A Tornado chart shows the effect of changing each assumption on the results, say NPV profit.

- Scenarios: Define scenarios by selecting values for each assumption to explore a range of future trajectories.

- Probabilities: How to estimate the chance that profit will exceed the investment? Express the uncertainty about each assumption as a probability distribution. It automatically computes the implied distribution.

“Once clients see the effects of uncertainty on payback and profit illustrated graphically as Analytica models, they become much less intimidated by the data, and ultimately, more profitable decision makers.”

Robert Brown III,

Partner, Decision Incites, Inc., Atlanta, Georgia

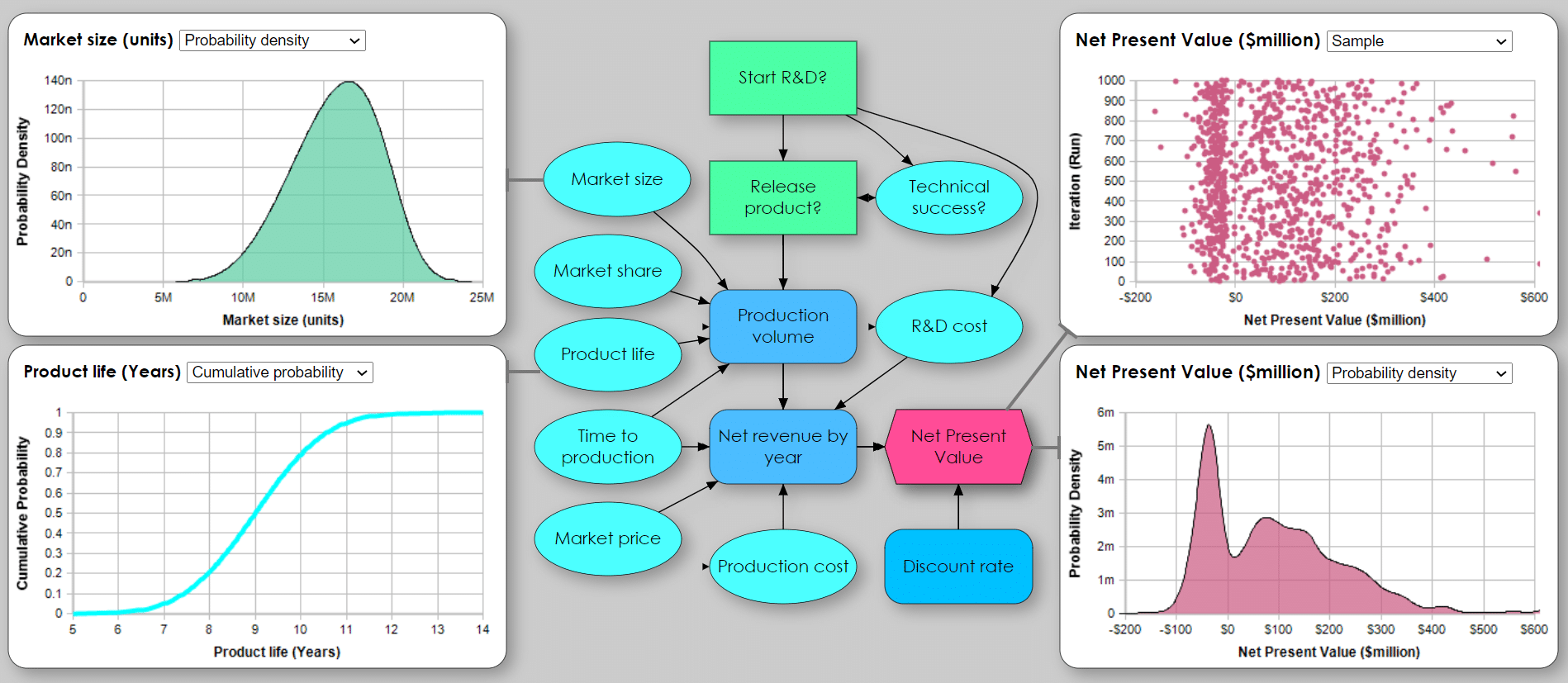

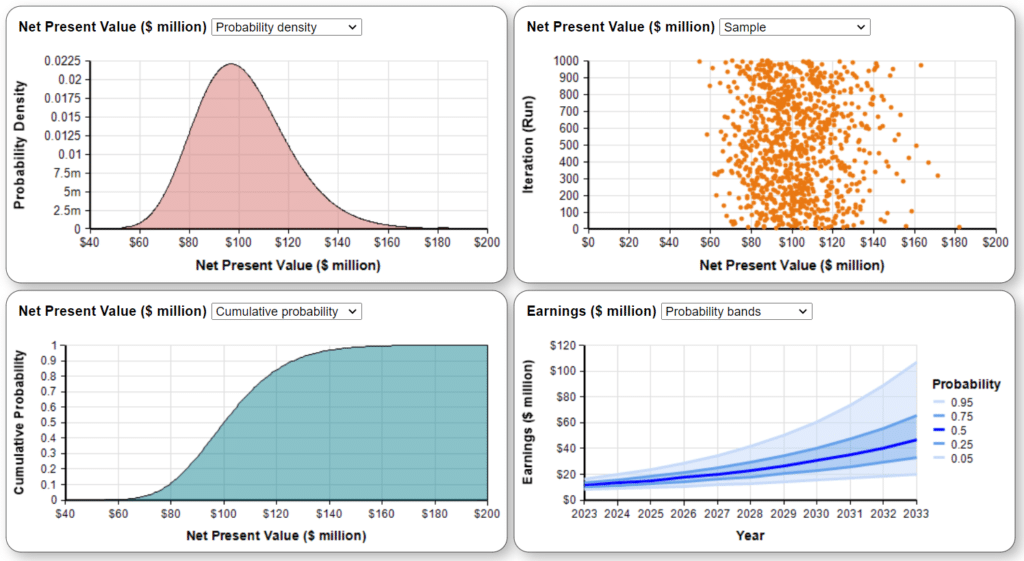

Probabilistic uncertainty: Monte Carlo simulation

Analytica uses efficient Monte Carlo methods to propagate uncertainties through models. These are based on a sample of random scenarios drawn from each distribution. This all happens automatically, under the hood. All you have to do is to select a distribution for each uncertain assumption—here’s a guide to help. It generates the resulting distribution automatically when you view each result.

It offers several sophisticated techniques that work faster, giving more accurate results with smaller sample sizes than standard Monte Carlo—Latin hypercube sampling and Sobel sequences. Importance sampling is efficient for rare but high-impact events—such as catastrophic floods, fires, or cyber attacks—for which other methods are impractical.

“Overall, the Monte-Carlo engine implementation appears to be very efficient, allowing results to be calculated quickly.”

Tony Cox,

PhD, J. of Human and Environmental Risk Assessment

Insight: visualize uncertainty

People vary widely in how they like to visualize uncertainty. Analytica offers a wide range of options including probability density functions, cumulative distributions, exceedance probabilities, credible intervals (e.g. 10th, 50th, and 90th percentiles), and even a scatter plot of the underlying samples. Choose the view that gives your clients the most valuable insights.

“We liked the way we could use probability distributions to be explicit about uncertainties. Analytica can flexibly display simple point estimates or entire probability density plots, according to the interest of the user.”

Eric Pan,

MD, Center for Information Technology Leadership, Boston, Massachusetts

Avoid “analysis paralysis”: discover what matters and why

Analytica offers a powerful range of tools for sensitivity analysis to discover which uncertainties matter, and why. Tornado charts show which assumptions have the most impact on the objectives you care about. Switchover analysis reveals how much an assumption must vary to change the recommended decision. Importance analysis shows how much uncertainty is due to each input. The value of information tells you how valuable additional data could be.

These tools help you avoid “analysis paralysis” by showing where to improve a model—and when it’s ready to support a confident decision.

“We chose Analytica because the probabilistic nature of model relationships was consistent with our view of stochasticity as an inherent property of natural systems.”

Professor Mark Borsuk,

Duke University, North Carolina

Beyond big data with human intelligence: how to navigate unprecedented situations

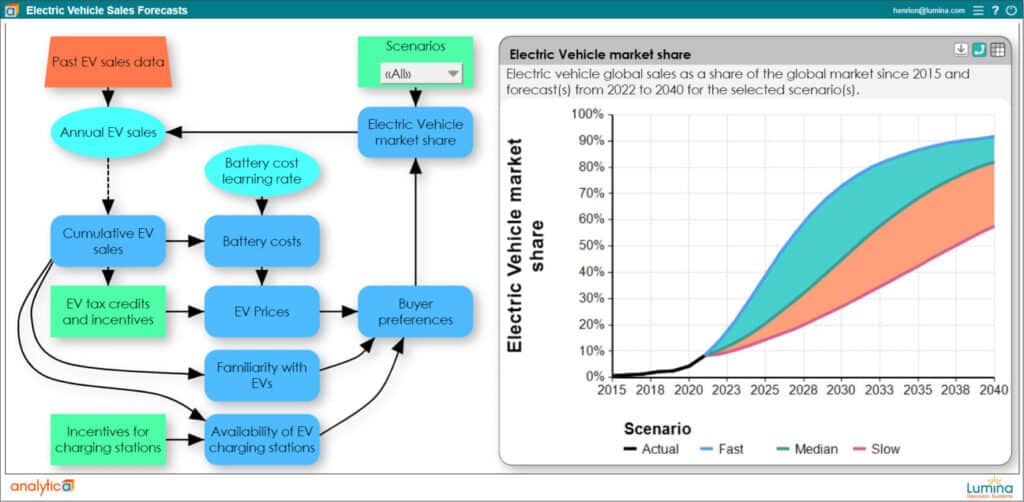

Big data along with machine learning help us understand the past. But they do little to improve long-range forecasting in times of unprecedented change. Consider a car maker that needs to forecast demand for electric vehicles to decide investments in new factories. Analyzing past data when EV sales were minimal won’t help. Instead, they need a dynamic model of the automobile market with key driver data, such as changing battery costs, gasoline prices, charging infrastructure, and consumer preferences. Historical data isn’t enough, you must rely substantially on expert human judgment that understands the rapidly changing factors.

A good strategy should be resilient and flexible enough to prosper under uncertainty. Analytica is an ideal tool to build such models: it makes it easy to model the dynamics with feedback loops, such as how increasing EV sales could lead to more charging stations, consumer acceptance, and falling battery prices, which further accelerate EV adoption. Such a model helps executives discover strategies so that their organizations can thrive in a wide range of potential futures.

Effective management of volatility, uncertainty, complexity, and ambiguity (VUCA) provides a competitive advantage for a business. And it’s critical for us to thrive as a society.