Analytica > Risk & uncertainty > Page 4

Risk & uncertainty

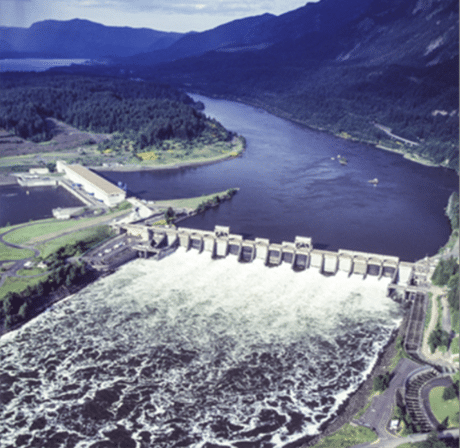

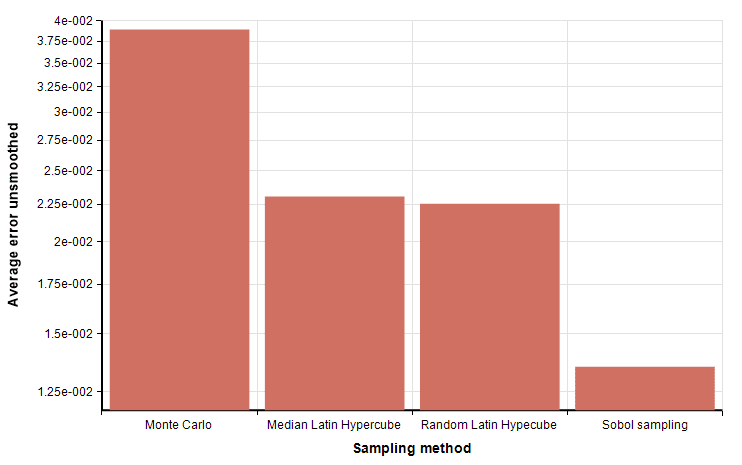

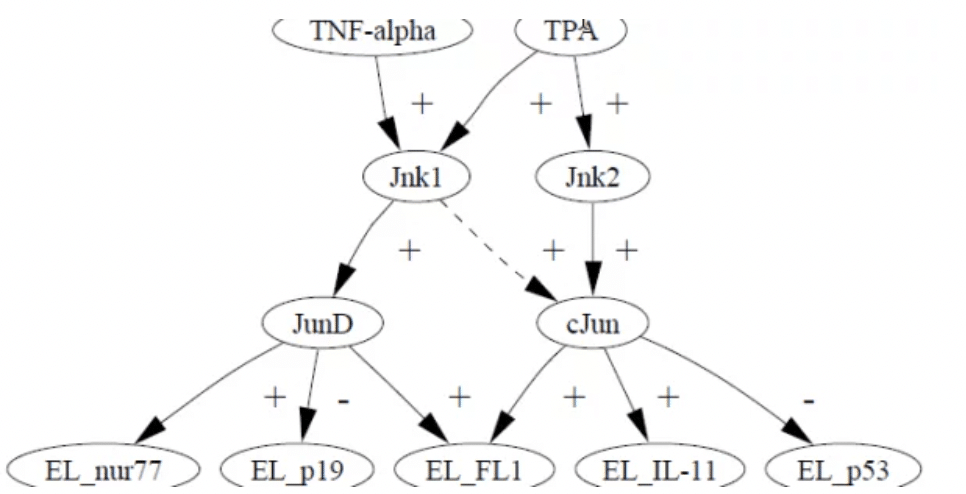

From its inception, Analytica was designed to analyze risk and uncertainty — unlike spreadsheet applications which require special add-ins. Analytica’s fully integrated features for sensitivity analysis, scenario analysis and Monte Carlo simulation make it remarkably simple to treat risk and uncertainty in your models. Here are some examples of how organizations are using these methods.

Some Analytica customers